Are you tired of watching opportunities slip away? Do you need to capitalize on fleeting moments of profit?

You need to leverage Algo Trading! It is the future of trading, which is driving more traders to earn more profits. Algorithmic trading is a popular stock market strategy that ensures better returns compared to traditional human intelligence-based trading. Algo Trading is a solution that acts as your tireless trading assistant that works for you 24/7 analyzing markets, identifying opportunities way faster than humans, and removing emotions from your decisions that tend to go wrong.

Therefore, You need to tap on the right algorithm trading strategies through the best Algo Trading platform that ensures you better returns. Algo Trading helps traders make profitable trades in the equity market, commodity, and forex trading.

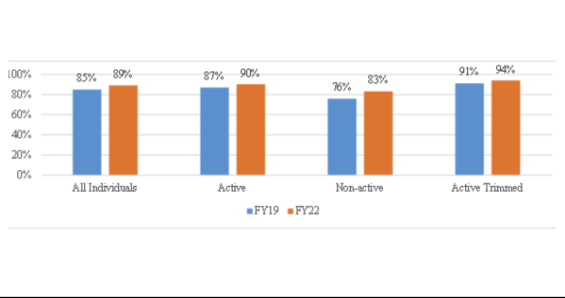

According to SEBI reports, 90% of active traders in FY22 incurred losses.

Percentage of Individual Traders Incurring Losses: FY19 vs FY22

Source: SEBI

According to this report published for the analysis of profit and loss incurred by individual traders in FY19 TO FY 22, 89% of the individual traders (i.e. 9 out of 10 individual traders) in the equity F&O segment incurred losses during FY22, up from 85% in FY19. The percentage went up to 90% for active traders and further to 94% on excluding the outliers from active individual traders' group (active trimmed) during FY22.

This high prevalence of losses among traders highlights the need for more sophisticated trading strategies. One potential solution is the adoption of advanced algorithmic trading (Algo Trading). Algo Trading leverages automated, pre-programmed trading instructions to execute market orders at optimal times, reducing emotional decision-making and improving efficiency.

Powerful algorithms and data analysis help traders better predict market movements, mitigate risks, and potentially convert losses into profits

Turn the Tide: Make Losses a Thing of the Past with Advanced Algo Trading

Algo Trading is an automated trading technology that uses computer-generated programs to execute market orders. It is programmed to follow a certain pre-defined set of rules and instructions based on stock price, timing, quantity, volume, and other parameters. This allows the system to execute the buy or sell orders at a lightning-fast speed without human intervention. Furthermore, it helps eliminate human emotions from the trade and capitalizes on opportunities you might miss otherwise.

One of the most important parts of algorithmic trading is tapping into the right trading strategies to get the maximum profit. Hence, getting the help of experts from the Algo Trading platform can help you achieve your trading goal much faster.

Now, comes the most common question from traders, Is Algorithmic Trading Profitable?

So let's delve into how Algo Trading is profitable

Algo Trading: Your Gateway from Market Losses to Financial Wins

Algo Trading provides several benefits to the traders that lead to more profitable outcomes. But to ensure the algorithm works correctly, you need to implement the right backtesting, validation, and risk management methods.

So, let's explore the reasons below:

#1 Algo Follows Current Trends

Algo Trading keeps track of the running trends by constantly monitoring the markets. It executes orders faster than human reach when the pre-defined conditions are met. It could be volume, price, resistance, and so on. Hence, Algo Trading makes sure you never slip away from any profit opportunity.

#2 Efficient Backtesting

Algorithm trading offers exceptional backtest that uses historical data to evaluate the current performance. It helps them refine the present trading strategy more efficiently.

#3 Faster Strategy Execution

Algo Trading software is designed to analyze the data at a lightning-fast speed. It can easily identify and execute trades compared to humans. For example, Algo Trading can identify 30 opportunities in 15 seconds, whereas human traders can take years to identify them.

#4 Reduced Emotional Factor

Algorithm trading eliminates the human bias or human emotions from trading, which could otherwise lead to impulsive trading decisions led by human fear and greed. Hence, fostering positive trading outcomes.

#5 Multiple Strategy Options

One of the major benefits of Algo Trading is its capability to execute multiple strategies simultaneously. It allows traders to design algorithms based on various market conditions like assets, risk tolerance, and more.

#6 Reduces Transaction Costs

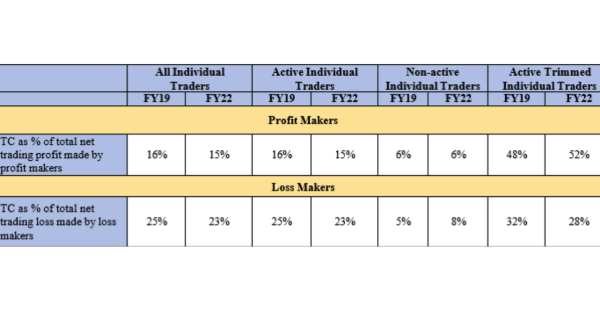

Algo Trading can significantly handle order execution and offer better entry and exit points. It helps traders in reducing their transaction costs on every trade. You can fact-check from the data published by SEBI.

As per the reports, In FY22, over and above the net trading losses incurred, loss makers expended an additional 28% of net trading losses as transaction costs (for the group of active traders excluding outliers), reflecting frequent trading. For non-active traders who made losses, the percentage was significantly low at 8%.

Even those making net trading profits, incurred between 15% to 50% of such profits as transaction cost. However, the percentage was significantly low at 6% for non-active traders who made a profit.

Transaction Costs as Percentage of Net Trading Profits/Losses

Source: SEBI

#7 Compliance And Risk Management Features

Traders can ensure risk-free trading and investor protection with compliance set on pre-defined rules and risk-free management parameters. It ensures transparency and fairness in the overall process.

#8 Offers more scalability

Algorithmic trading can monitor and analyze large numbers of stocks and portfolios with its efficient computational power. It opens more opportunities to achieve trading goals faster.

Popular Algorithmic Trading Strategies For Profitable Trading

Profitable Algo Trading Strategies require significant research on suitable Algo Trading Strategies that are implemented with a pre-defined set of rules.

Let's look at these strategies grouped into 3 sections.

Simple Algo Trading Strategies

- •Momentum strategy

- •Trend following strategy

- •Market time strategy

- •Arbitraging strategy

Popular Algo Trading Strategies

- •News based trading

- •Pairs trading

- •Swing trading

- •Black swan catchers

- •Inverse volatility

- •Risk on/ Risk off strategy

- •Index Fund Rebalancing

Profitable Algo Trading Strategies

- •Mean Reversion

- •High-frequency trading

- •Machine learning trading

- •Scalping trading strategy

- •Market-Making strategy

- •Quantitative strategy

Wrapping Up

Algorithmic trading (Algo Trading) is one of the popular trading technologies worldwide. It is highly beneficial for investors seeking better returns with fewer errors and more trading opportunities in the stock market. It is the fastest and most accurate system compared to manual trading.

You can even leverage the services of the Algo Trading platforms like Thrive Fintech to automate your trading process for better outcomes in the marketplace.